Comerica Bank’s customers who use its online banking system benefit from the multiple levels of security designed to protect their accounts and personal banking details. These include an industry-standard multifactor authentication (MFA) process and the requirement to create a user ID with eight to 15 alphanumeric characters and a complex password that the company encourages its customers to change every six months. Comerica Bank also has a security alert system in place to notify customers about scenarios such as a change in their security question, a password change and updates to their personal information. Discover more about these and other Comerica Bank online features and learn how they’re beneficial.

Comerica’s Extensive Security Protections

Comerica Bank professes its commitment to keeping clients’ sensitive personal information as safe and secure as possible. It does this using several methods that are built into its online system. From the moment you first log into your account, all information you input and receive is encrypted, meaning that it’s blocked and scrambled during transmission so that anyone who attempts to access it won’t be able to decipher it. Comerica’s system also logs you off automatically if it doesn’t detect any activity on your account for a set period of time. This comes in handy if you log in on a computer that isn’t your own and forget to sign out of your account.

The online banking portal, along with Comerica Bank’s entire website and other systems, is under constant monitoring to catch potential problems before they compromise your security or privacy. Comerica’s system also offers helpful authentication features in an effort to prevent unauthorized access to your online account, verifying both your credentials and activity in the process.

What Is Multifactor Authentication, and How Does It Help You?

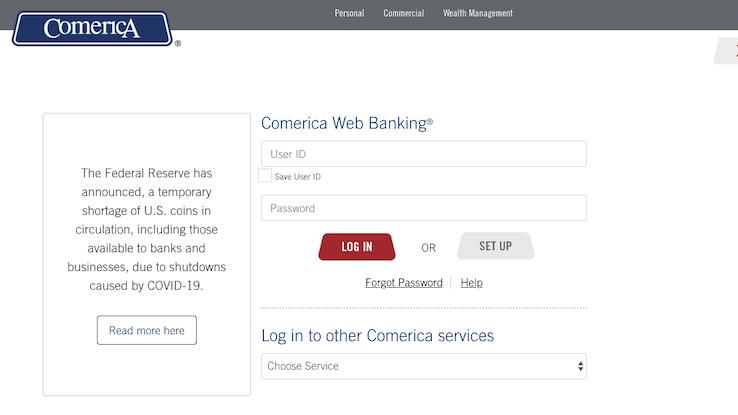

The MFA login protections that Comerica Bank has in place make up one of the most significant security features of its web banking system. In contrast with MFA, the typical details needed to log into some online accounts are just a username and a password. This is called single-factor authentication because it relies only on one factor: what the user knows, such as their username and password, which they chose themselves.

Multifactor authentication relies on several different elements to provide access to an account when signing in. In addition to what you already know, like your login username and password, you’re also required to provide another piece of proof, or factor, of your identity that isn’t something you already know. One of the most common examples of this involves receiving a one-time-use code at your email address or via a smartphone text message, which you then enter into a separate field when signing in.

Verifying your identity with a security token this way adds an extra layer of protection to your online account. For a hacker to access your online banking account when a website utilizes MFA, they’d also need to be in possession of your smartphone to receive a text with a code — which would be more difficult to achieve. MFA keeps your Comerica account more secure than single-factor authentication.

User IDs and Passwords Add to Banking Security

Comerica Bank’s web banking system requires you to have a unique user ID between eight and 15 characters long. For ease of use, some websites only require members to log in via their social media accounts or use their email addresses as login usernames. These login methods make it easier for unauthorized individuals to break into an online banking account because, if they know someone’s email address, it’s easier to correctly guess their usernames on various sites. Having separate credentials for logging in like Comerica does eliminates this risk.

Using a unique eight- to 15-character user ID can also help improve security by minimizing phishing — if a hacker only knows your email address and not your username, an incorrect username appearing in a scam email is easy to spot. Using unique and complex passwords works well in combination with a unique user ID simply because it makes it harder for hackers to steal this vital information.

Secure Web Banking Habits

Apart from Comerica’s security protocols for web banking, you can also take measures to protect your account from hackers. One of these measures is to change your password every few months just in case it becomes compromised during a large-scale hacking event. The passwords you choose must be strong; create them by combining lowercase and uppercase letters, numbers and symbols. You can also use a memorable phrase, which is harder to guess than a single word — think 1l0v3myd0g instead of ilovemydog. Don’t use obvious details like your name or birth year, either.

It’s also smart to do web banking only when you’re using a private network, like your internet at home. Using public Wi-Fi, such as the internet at your local coffee shop, makes you more vulnerable to hackers if the network isn’t secured with a password.

Comerica Bank will never ask you to send them an email that includes your private details, such as your username and password. To avoid phishing scams, always log in via Comerica’s official website instead of clicking on suspicious links that you receive via email.

Comerica Bank’s web portal offers the usual convenience of online banking like viewing your account statements, monitoring transactions, paying bills and making funds transfers. The bank also offers a manager feature, which allows you to assign limited access to other people who are listed on your account for transaction purposes. Comerica Bank notes on its website that it’s constantly investing in technology and processes to strengthen the security of member accounts, and you can receive periodic updates about its efforts (or report any scams) by visiting the Fraud Center.