At one point, savings bonds were a popular gift from grandparents/parents to children and young adults who could eventually redeem the value of these unique investments. While they’re less common now, they’re still a valid form of investment that can be turned into hard cash higher than their purchase value. Do you have savings bonds lying around in a drawer somewhere with no clue what they’re worth or how to cash them in? This is a look at savings bonds, including what they are, how they work, what they’re worth, how to buy one, and how to cash them in once they’ve matured.

What are Savings Bonds?

Savings bonds are a kind of Treasury bond that is authorized and issued by the U.S. government. Purchasing a savings bond loans money to the government, which will then accrue interest and credit back to you at a higher value than the original purchase price. Savings bonds are bought at their face value, then accrue interest, exceeding their original value once the bond has matured. Their interest only becomes valuable to you once you cash out the savings bond, which is most valuable at its full maturity (typically between 20 and 30 years).

How do Savings Bonds Work?

Like all loans, savings bonds accrue interest over time. Unlike traditional loans, the owner of the bond only receives the bond’s interest once the savings bond is cashed in. You can cash your savings bond in as early as twelve months after purchasing, but this isn’t the smartest move. Savings bonds continue to collect interest up to thirty years after the purchase date, so they become more valuable the more you allow them to age. When you are ready to cash them in, you can do so at your financial institution/credit union.

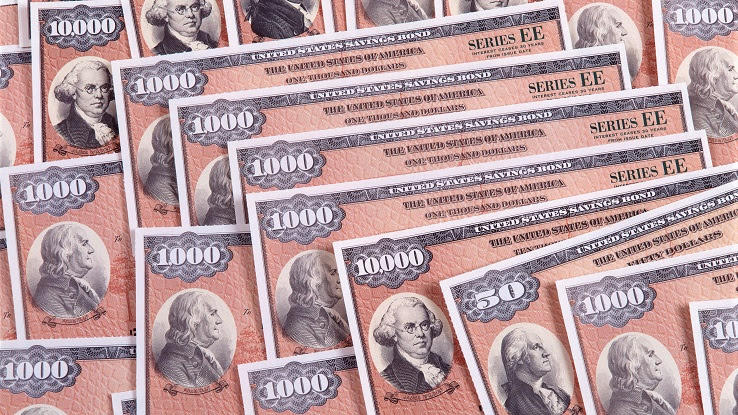

There are two kinds of savings bonds:

- Series EE bond: This common kind of bond is bought at half of its face value and matures with a fixed interest rate. These bonds mature fully over 30 years until they reach double their value. For example, a series EE bond worth $50 at face value will eventually be worth $100.

- Series I bond: These bonds protect against the impacts of inflation by integrating both a fixed rate and an inflation-adjusted rate. This type of bond is supposed to ensure that drastic inflation rates won’t tank the value of your bond, with the interest rate being determined by both a fixed value and by the Consumer Price Index (CPI).

When do Savings Bonds Mature?

Understanding the maturity date of your savings bonds ensures you get the most out of your investment. Bond types that are no longer being issued, such as series E or series H bonds, have already reached their maturity and can be cashed in at any point. Series HH bonds, which stopped being issued in 2004, reach their full maturity after 20 years, so bonds issued in 2004 will continue to mature until 2024. In the case of series EE bonds and series I bonds, it takes 30 years for these bonds to fully mature from their date of purchase. You can find out if your bonds are mature by using the Treasury’s website. They feature a useful table that allows you to determine if your type of bonds are mature and/or if they’ve stopped earning interest.

How Much are Your Savings Bonds Worth?

The value of your bond depends on the type of bond you’ve purchased. Paper EE bonds, which were issued up until 2011 before being replaced by electronic bonds, are worth twice their face value at their maturity (30 years). A paper EE bond purchased at $100 would be worth $200 at its full maturity, $200 bonds would be worth $400, and so on. Electronic EE bonds mature after 20 years, at which they are worth twice their face value, though they continue to collect interest for up to 30 years. Waiting the full length of time to cash out these electronic bonds ensures that your bond will be worth more than twice its initial value. Series I bonds are sold at their principal value, and accrue interest with an adjusted interest rate every six months, with interest earned for up to 30 years. Although this bond doesn’t double in value, a positive interest rate can turn this type of bond into a highly valuable investment.

How to Buy Savings Bonds

Getting your hands on a savings bond is simple: savings bonds can be purchased at TreasuryDirect.gov. The only way that you can purchase series EE bonds is through the U.S. Treasury’s website. They no longer issue paper series EE bonds, so these bonds will be solely electric, which makes them easier to manage (and they’ll be less likely to get lost in your files). You can purchase series I bonds electronically, as well, though you can also purchase paper series I bonds by requesting them through your federal tax return. You’ll need to attach IRS Form 8888, indicating that you want to use a part (or all) of your refund to purchase series I paper bonds (up to $5,000 a year).

How to Cash Out Savings Bonds

Cashing out paper savings bonds is a fairly simple process. You can take the savings bond to your local financial institution/credit union. Most banks will honor your bonds, be able to process them, and deposit the money directly into the account of your choosing. If you’re uncertain about your bank’s ability to handle bonds, give them a call beforehand to ensure that they can cash them out for you. Be sure to clarify any information that they might need you to bring along (I.D. card, account number, etc.). Know that you can only cash out a savings bond if it is under your name (or if you are listed as a co-owner). No one can “gift” you one of their savings bonds, as they will not be able to process a bond that is not with the person who is legally entitled to the invested money.

If your bank is unable to process your bonds, you can also mail your savings bond to the Treasury Department itself. First, you’ll need to go to your bank and get verification that the signatures on your bonds are valid from a banker. Then, you’ll have to mail in your bonds, a canceled check, and your Social Security Number to the Treasury, at Treasury Retail Securities Site, PO Box 214, Minneapolis, MN 55480-0214. They’ll use the canceled check to identify your account number, then will deposit the value of your savings bonds directly into your account.

Online bonds are the easiest to cash out. You’ll simply need to set up an account on Treasury.gov and go to “current holdings.” There, you’ll be able to see all of your bonds and their current value. If you’re ready to cash them out, the website will lead you through a few simple steps to get the money deposited into your bank account.