SunTrust’s online banking system works in much the same way as other banks’ systems do. Using SunTrust’s digital banking platform, account holders who sign up for the service can view and manage their accounts over the internet using a computer or a mobile device. You can pay bills, transfer funds, set up balance alerts and access credit card options.

Depending on the type of account you have with SunTrust, you’ll also have access to your checking account, savings account, certificate of deposit account, credit cards, individual retirement accounts (IRAs), mortgage, lines of credit and installment loans — all on a single page once you log into SunTrust’s online banking portal. Learn more about the platform’s functionality to make the most of your online banking experience.

What Bill-pay Options Do You Have?

One of the primary conveniences of online banking is that it gives you a way to pay bills without having to leave home — or to do so on the go using a mobile device. It’s simple and easy, so it comes as no surprise that data show Americans pay approximately 56% of their bills online.

SunTrust’s online bill-payment portal incorporates several features that make the process of setting up payments easier. You can set up periodic and regular reminders to pay bills and activate alerts on your payment dates. One-time or recurring automatic pay options are available, and you can also customize the amount and frequency of each payment.

Another bill-payment feature the bank offers is eBill. Using this service, you can opt to receive some types of bills electronically and also receive alerts for paying these bills via emails and the online banking app when the due dates are approaching. This can help you track and manage both your payments and your budget more efficiently in one place using the bank’s online portal.

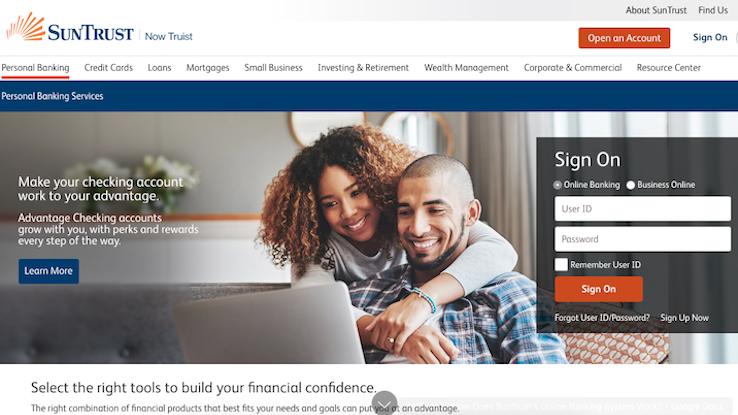

SunTrust clients do have to enroll their accounts before they can use the company’s online banking services. When enrolling via SunTrust’s online banking portal, you should have your account number, ZIP code and the last four digits of your Social Security number on hand and ready to provide when prompted.

Can You Make Internal Payments and Funds Transfers?

SunTrust clients who hold several account types will find it convenient and efficient to transfer funds between their accounts online. You can complete internal payments, such as those for SunTrust loans and credit cards, using the online banking app. As with bill payments, you can choose and schedule payment dates that work best for you, such as a few days after your payday.

You can also use SunTrust’s online banking system to transfer funds to or from other U.S. financial institutions. Transferring money into a SunTrust account is free, while transferring funds from SunTrust accounts to other banks may incur some fees, depending on the other banks’ policies.

SunTrust’s online system also allows you to send, receive and request payments to and from another person who holds a U.S. bank account. This service is available if you’ve enrolled your email address or mobile number with Zelle payment services, which is a payment network that’s similar to Venmo and other digital money-transfer apps. While there are some limits to Zelle transactions, such as $500 weekly limits in certain circumstances, payments and transfers utilizing this system usually process within minutes.

How Secure Is SunTrust’s Online Banking?

Although online banking provides convenient solutions for various services, it also comes with risks — like threats from cybercriminals. Bank fraud has gone digital, courtesy of hackers who are always on the lookout for ways to digitally exploit banking systems. Rather than break into a bank’s own online system, however, most hackers prefer to focus on individual banking clients and mobile banking app users, who are typically easier targets because they have less-secure devices and accounts.

On its website, SunTrust reminds users of some of its security practices, including that it doesn’t send out emails or text messages to its clients to ask for sensitive information. One of the most common tricks hackers employ is to send official-looking emails or text messages to individuals, often with alarming messages to trick them into disclosing confidential information or opening links that install viruses.

This information, which typically includes passwords, Social Security numbers and credit card numbers, is often all that the hackers need to break into an individual’s bank account and steal money. SunTrust encourages its clients to be cautious about such emails and play an active role in stopping bank fraud against themselves before it starts.

The bank likewise shares a security checklist with tips you can use to fortify security on your own accounts on various devices. Included in the checklist are measures you should utilize to protect your information and online banking profile, such as using complex usernames and passwords, enabling activity alerts, opting for paperless transactions and using a free identity theft-protection app.