Opening a health savings account (HSA) allows you to set money away for pre-approved medical expenses. You can reduce copayments, deductibles and other health insurance costs by utilizing untaxed HSA money to pay for these expenses. In general, you can’t use HSA money to cover the cost of your insurance policy’s premiums — but there’s a lot you can cover with it.

People who are eligible for an HSA can make contributions on their own or on behalf of someone else who’s eligible for an HSA. A person qualified to make HSA contributions could be an employer or a family member. It doesn’t matter whether or not the person who’s eligible for a tax deduction itemizes their deductions, either.

While these HSA rules generally don’t change from year to year, others do. And, it’s important to be aware of the changes if you have an HSA account. Read on to learn more about HSA updates for 2022 you should keep in mind.

HSA Changes for 2022

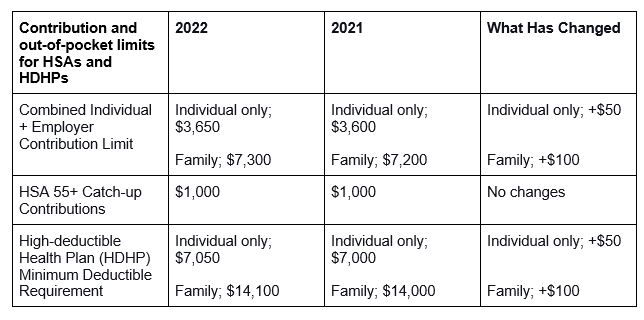

The IRS Revenue Procedure 2021-25 raises the HSA contribution limits for 2022 by $50 for individuals and $100 for families. This means individuals can contribute up to $3,650 annually, and families can contribute up to $7,300. That’s a 1.4% rise from 2021.

The yearly out-of-pocket maximums have increased slightly in 2022, according to Roy Ramthun, president and founder of HSA Consulting Services, a nationally renowned authority on HSAs and consumer-directed healthcare. So, for 2022, health plans don’t need to change much. Here’s a quick comparison of the changes between 2021 and 2022:

HSA Eligibility Requirements

You can begin an HSA account through your employer or open an HSA account individually through a bank or other financial institution. You must be under age 65 and have high-deductible health insurance — also called a high-deductible health plan, or HDHP — to qualify.

Your spouse must be enrolled in a high-deductible plan to use your insurance as supplementary coverage. The HDHP must be your sole health insurance plan, although you may still choose to have dental, vision, long-term care or disability insurance. To be eligible for an HSA contribution, you must meet the following criteria:

- On the first day of the month, you must be enrolled in a high deductible health plan. To be qualified for an HSA, you must have high-deductible health insurance with a deductible of at least $1,400 for individuals and $2,800 for families.

- You have no other health coverage than what is allowed later. (Read more about what healthcare coverage is permitted under other health coverage in IRS Publication 969).

- You don’t have Medicare.

- You are not a dependent or can’t be claimed as a dependent on someone else’s tax return.

Pros of Opening an HSA

If you don’t already have an HSA, there are some advantages to consider when deciding whether to open one:

- Helps pay medical costs: Various medical, dental and mental health services are covered. IRS Publication 502, Medical and Dental Expenses, elaborates.

- Flexibility: Anyone can contribute to your HSA, whether that’s you, your employer, a family member or someone else.

- Interest and earnings: Interest and earnings on HSA accounts are tax-free. Most HSAs earn less than 0.1%.

- Carryover funds: Money in your HSA rolls over at the end of the year. The maximum carryover for flexible spending accounts is $550, or 2.5 months.

- Portability: In the event of a job loss or retirement, your HSA savings remain available for future medical needs. In addition, you control how the money is used in your HSA.

Cons of Opening an HSA

While HSAs are a great way to save for unexpected medical costs, there are also a few cons to consider:

- High deductibles: HSAs are only available with a high deductible health insurance plan. And, remember that you’re paying your deductible before the insurance covers medical bills. A copay is required until you meet your deductible.

- Hesitancy to use HSA funds: Saving for an HSA might be challenging for some people, and they may not obtain needed medical care because they don’t want to use their HSA savings.

- Penalties: If you utilize HSA funds for nonqualified expenses before age 65, you’ll owe taxes plus a 20% penalty. The penalty is waived after 65.

- Difficulty compiling data: You must keep receipts to prove you used your HSA withdrawals for approved medical expenses. The IRS needs this information for any HSA withdrawals you make.

Is an HSA Plan Right for You?

If you have high-deductible health insurance, you can utilize an HSA to save money on deductibles and copays. You own the HSA, and unused funds roll over year after year. For most people, the major benefit of having an HSA is seeing the tax savings. Your HSA account entitles you as its owner to various tax advantages. For example, whether you itemize or not, you can deduct HSA contributions from your taxable income. You can also get a tax deduction if someone else contributes to your HSA.

The best health savings plan for you will depend on your unique medical and financial situation, your employer’s health insurance options and HSA alternatives. HSAs, like any healthcare choice, have pros and cons. Consider your budget and future healthcare needs as you weigh your options.

If you’re in good health and want to save for future medical bills, an HSA may be a good option. If you’re nearing retirement, an HSA may make sense to help pay for future medical expenses. However, an HSA and high-deductible health plan may not be the ideal option if you anticipate needing costly medical care in the next year — you’ll need to pay your deductible out of pocket first.