Economic commentators and political pundits alike are often discussing the United States’ national debt, a tab that’s accrued when the federal government helps pay for social programs, infrastructure, and other initiatives and features Americans rely on.

When the national debt is too high, economists become concerned about inflation, tax increases, and political and economic changes. But what bearing does the U.S. national debt have on the lives of everyday Americans? We’re delving into everything you need to know about the country’s debt.

What Is the U.S. National Debt?

The national debt is often a hot-button issue during political debates and the subject of many campaign promises. Like individuals, governments are able to borrow money when they have more financial needs than money on hand. Over time, governments are expected to pay that money back. In short, the U.S. national debt is the sum amount of money the United States owes to creditors at any given time.

So, how does this debt get calculated? Well, there are two ways to measure national debt. While a traditional dollar amount can illustrate what the government owes, economic watch dogs often prefer to measure the debt as a percentage of the nation’s gross domestic product, or GDP.

Put simply, the gross domestic product for the nation is similar to your gross income as an individual. That is, it’s the total revenue from all of the products made and services sold within a given country. The government collects taxes on that revenue, so viewing the U.S. national debt in terms of America’s GDP is a measurement of how feasible it is that the government will be able to pay back its creditors.

This is similar to the way lenders evaluate individuals based on their loan-to-income ratio. A person with debt representing a smaller percentage of their total income is seen as more creditworthy than an individual with a large portion of income consumed by monthly debts. So, what does the U.S. national debt look like? By the end of 2020, the U.S. government had racked up nearly $27 trillion in debt, and the total debt represented 128% of the U.S. GDP for that year.

How Does the National Debt Impact Investors?

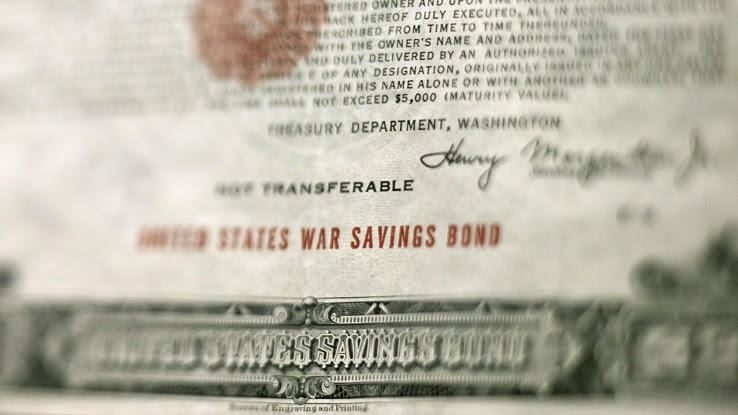

One way that the government increases its income to pay off the national debt and address annual budget deficits is by offering higher treasury yields to investors. People, businesses, and even foreign countries purchase U.S. savings bonds. The bond is purchased for an initial amount with the promise of receiving a higher amount back from the U.S. government in the future.

The treasury yield is similar to an interest rate because it is the additional percentage that will be tacked onto the principal investment amount. When the treasury yield is higher, investors earn a higher return on their investment. Just as investors carefully study the stock market before making purchases, investors analyze the national debt and annual budget deficits before buying bonds.

If the national debt is high and the government stays under budget year after year, investors expect higher treasury yields. Many large companies invest heavily in government bonds, and foreign companies use financial indexes that factor in America’s national debt when determining the viability and creditworthiness of businesses based in the U.S. All of these factors can lead to businesses facing higher costs — and, eventually, those costs are passed on to consumers in the form of higher-priced goods and services.

As we’ve noted in our discussion of inflation and interest rates, “When the national debt goes up, the government has to find a way to keep making payments. The first option? Raise corporate taxes on large companies, which, in turn, will often shift the cost burden to their customers. Their second option is to print more money, which can often lead to higher prices on goods simply because there’s more money to be spent. Both can lead to inflation.”

How Does the National Debt Impact Citizens?

While the government’s creditors are not likely to send citizens a bill, the national debt does have an impact on Americans’ finances. For example, increases in treasury yield mean that less of the money the government earns through taxes in a given year is available to spend on its citizens. The extent to which this lack of funds is felt in an individual’s life depends on the government programs that person relies on (and on what Congress chooses to cut).

Overall, when the government has less money, the existing services it offers are scaled back — or cut altogether — and there’s a limit on the amount of new services it can introduce. Although education budgets do not always come directly from federal funds, low teacher wages and a lack of adequate teacher-to-student ratios in schools are two examples of areas where a lack of budget money causes a lack of access to quality resources for a large portion of Americans.

Moreover, there is a direct correlation between the treasury yield and the interest rate on mortgages backed by federal programs. Federal mortgage loan programs are often the easiest programs for people with lower incomes and higher debt-to-income ratios to qualify for, and an increased mortgage rate can make a big difference in both the total cost and monthly payments of a mortgage.

The most basic way for the government to earn revenue is through taxes. Just as an individual may take on a second job to pay off debts, the government can resort to raising taxes to pay off debts. When income taxes are higher, people have less net income to spend. When business taxes increase, some businesses respond by laying off employees, cutting benefits, or raising prices. Even for people who do not need a mortgage or who do not rely on the specific government programs that are cut when the national debt grows too high, all consumers feel at least a slight impact.

How Should the U.S. National Debt Impact Personal Financial Decisions?

While the U.S. national debt has a varying degree of impact upon the budgets of every household, the current burden upon individuals is not considered too heavy. However, it is important to understand the far-reaching effects of an increasing national debt. Since 2010, the national debt has consistently been higher than America’s GDP for each year.

As the situation worsens, the impact on individuals could become greater. Certain government benefits could start to dry up, and households would need to find alternatives. (Although the two concepts are often linked, funding for social security benefits is not a factor in the national debt because it is considered to be mandatory spending.) People who are already in higher tax brackets may face steeper taxes in coming years, though, in most cases, it’s still not a detrimental chunk of their total earnings. Additionally, it may be prudent for prospective homeowners to take advantage of low interest rates before the national debt drives them up higher.

Although the national debt seems far removed from the average American, understanding its relationship to individual financial decisions helps consumers make wise choices that better both their present and their future.