If you are old enough, you may remember those distinctive yellow Ticonderoga wooden pencils, used by students in grammar schools across America. At the center of those pencils was graphite, which enabled them to write words and sentences.

Today, graphite is used in many industrial and commercial applications. Its extreme properties give it a wide range of uses in metallurgy and manufacturing. Some of the applications include the manufacturing of powerful batteries needed in electric vehicles.

What Is Graphite?

Graphite is a crystalline form of carbon. It occurs naturally in some metamorphic and igneous rocks. It is a very soft mineral that has extremely high resistance to heat and is chemically inert when in contact with most other materials.

Graphite can be made synthetically. Materials such as petroleum coke or coal tar-pitch can be heated to produce synthetic graphite.

Why Is Graphite Important in Today’s Economy?

Graphite has a myriad of uses, In today’s economy, however, it is critical in the production of lithium-ion batteries, solar panels, steel, and lubricants. In fact, each battery in an electric vehicle requires between 50 and 100 kg of natural or synthetic graphite.

Clearly, there is a great need for graphite in modern commercial activities. The demand for graphite is expected to rise greatly. In 2019, the value of the global graphite market was $14.3 billion; by 2027, it is expected to grow to $21.6 billion. Much of this strong demand for graphite will be fuelled by the growth in the high-tech batteries and energy storage sectors.

Who Produces Graphite?

By far and away, the major producer of graphite is China, which mined approximately 650,000 metric tonnes in 2020. The next largest producers of graphite are Mozambique (120,000 metric tonnes), Brazil ( 95,000 metric tonnes), and India (34,000 metric tonnes). Although not one of the top four producers, Sri Lanka may hold pride of place because it is the only country in the world that produces vein/lump graphite, the best type for commercial applications.

As of 2019, graphite was not produced domestically in the United States, despite its utility in modern technology. Nonetheless, about 95 companies used some 52,000 tons of graphite, representing approximately $44 million of value. Known deposits of graphite, however, occur in New York, Pennsylvania, Texas, and Alabama.

Graphite Versus Graphene

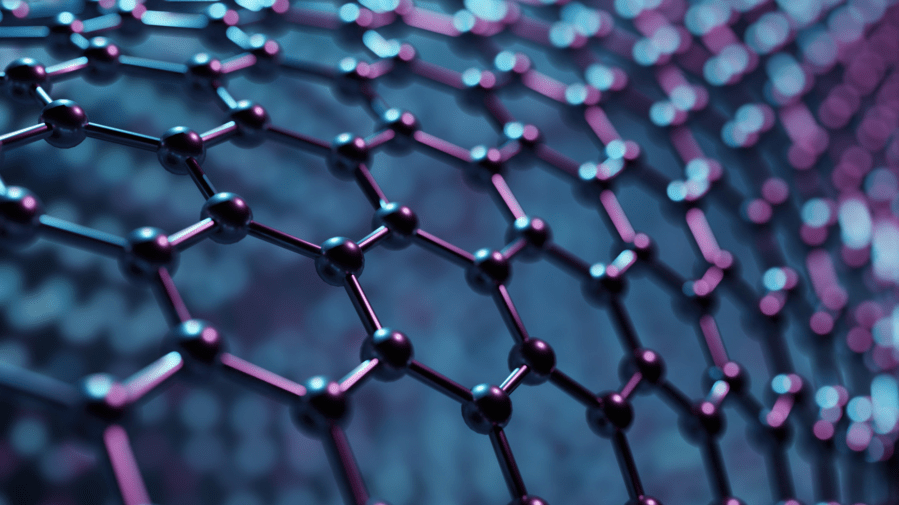

Graphite can be “supercharged” for many high-tech applications when it is converted to graphene, which is a single-layer sheet of carbon atoms arranged in a repeating pattern of hexagons. This layer is only 0.33 nanometers thick.

Graphene has a unique set of hugely important properties: Despite its thinness, it has incredible strength; it conducts heat better than any other material; it is a superb conductor of electricity; it is optically transparent, and it is impermeable to gases.

The multi-fold properties of graphene are being studied at research and development think tanks and are already being used in a wide variety of needed applications. Indeed, Annick Loiseau, from the National Office for Aerospace Studies and Research (ONERA), has coined the phrase “The future lies in pencil graphite!”

Several issues revolve around the large-scale commercial production of graphene from graphite. These include ensuring that the single layers are perfectly defect-free, and the use of toxic substances during its synthesis.

Is There an Investment Opportunity in Graphite?

With its expected surging demand going forward and concerns about the supply from China, the investment thesis for graphite remains strong. Despite the compelling story, it is not as simple to invest in compared to other commodities: unlike gold and silver, it is not traded on an exchange.

Lager companies that are involved in the graphite sector are found in China, India, Brazil, Canada, and Sri Lanka. Due diligence may uncover some opportunities for the intrepid investor.

Some investors are choosing to search out smaller graphite exploration and mining firms. Many of these will be so-called ‘junior miners”, whose stock prices may fluctuate greatly during the investors holding period. Investors may be able to research some of these using sources such as Investor Intel.

Staying abreast of the happenings in the graphene R&D space may prove fruitful. Some investment opportunities may become apparent going forward.

Another theme to keep an eye out for would be the development of recycling opportunities. Large-scale commercial recycling of old batteries and other graphite-containing materials may be on the horizon.

Although there are currently no specific graphite exchange-traded funds (ETFs), investors may find some exposure to the graphite market in metals and mining, solar, and lithium ETFs.