Prepaid debit card accounts like Netspend are popular for many reasons. Consumers often want to eliminate the risk to their personal bank accounts by paying for purchases with prepaid debit cards. These cards only have access to limited funds — the amount you choose to deposit — rather than the full amount in your bank account. In other cases, consumers need to reestablish a positive banking history before they can open a traditional bank account, or young adults use them to control their spending while they learn how to manage their money.

Online shopping and many other types of purchases require a debit or credit card, which makes some type of payment card a necessity in today’s world. As a debit card with either the Visa or Mastercard logo, Netspend cards allow you to deposit as much or as little as you want, giving you the freedom to make card-only purchases with a quick swipe. Here’s a quick look at how Netspend works hand-in-hand with your bank account.

Use Your Netspend Account to Pay for Purchases

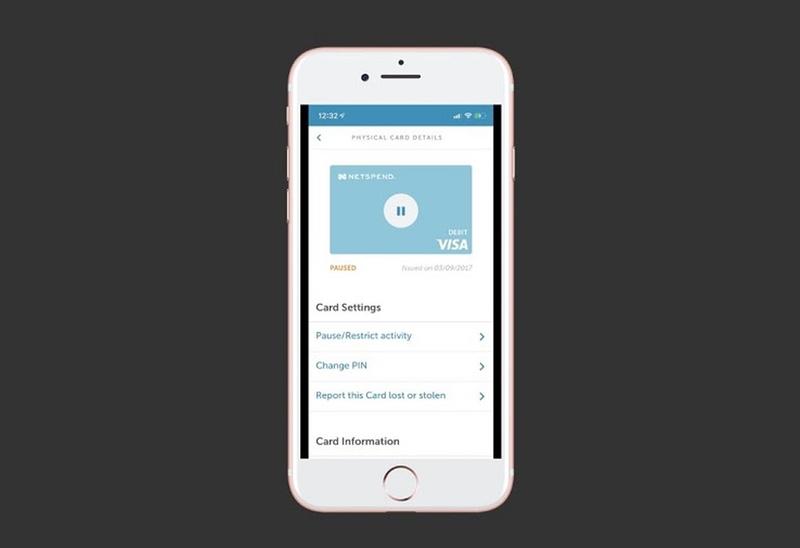

Netspend provides customers with prepaid Visa or Mastercard debit card accounts without charging activation fees or requiring credit checks and minimum balances. Unlike prepaid debit gift cards, Netspend prepaid debit cards are attached to accounts with your name and address associated with them. The cards have your name printed on them along with an expiration date and security code, just like credit cards.

Although they operate a lot like credit cards, Netspend cards do not require a hard credit inquiry for approval, but you do have to verify your identity to receive a card. In addition to manually adding funds to the card, you can set up direct deposits into your Netspend account to give you quick access to paycheck funds via your card.

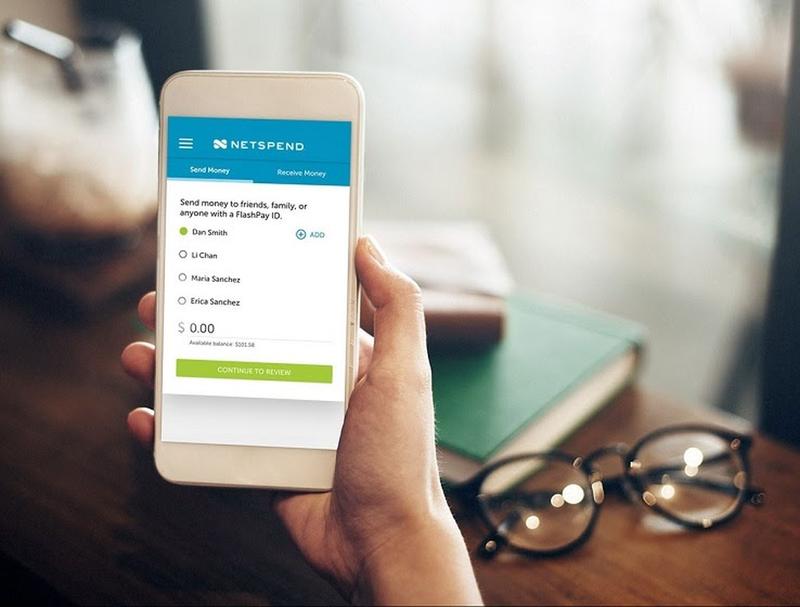

Send and Receive Money with Netspend

Once you set up a Netspend account, you can also send and receive money between Netspend, ACE Elite, Control and Purpose cardholder accounts. You can do this in several ways, including by setting up direct deposits and quick money transfers using FlashPay IDs.

If you have a PayPal account, you can transfer money from your PayPal account to your Netspend card and vice versa. For easy transfers, download the Netspend app and link the two accounts together in the Netspend app and in the PayPal app. Once you complete those steps, you can send and receive money from your PayPal account and use your Netspend card as a payment source for PayPal. Depending on your Netspend account, you may also be able to send and receive money using wire transfers through Western Union.

Transfer Money to Your Bank Account

Netspend prepaid debit cards are generally used to make purchases, which means it’s more common to transfer money out of your bank account to your Netspend card using the website or a mobile app. You link your accounts when you set up your Netspend account to enable instant transfers from your bank to Netspend. However, you can also transfer money out of your Netspend account to your bank account — with a little extra effort.

The workaround is simple, although it takes a few extra steps and possibly a few extra days. If your PayPal account is linked to your bank account, you can transfer funds from your Netspend account to your PayPal account and then transfer the funds from your PayPal account to your bank account. This process could only take minutes if PayPal doesn’t put a hold on the funds from Netspend, and you use the instant transfer option on PayPal (for a fee) to transfer the money to your bank. Otherwise, it could take several days to complete all the transfers.

Make sure you understand the rules and associated fees for making transfers at all three institutions: Netspend, PayPal and your bank. Some banks and financial institutions have daily transfer limits as well as fees for transfers, so making multiple transfers within a short time frame or transferring large sums within a short time frame could result in fees. Check with your financial institution before making any transfers.