It’s no secret that prepping your taxes can get a little complicated, and being retired can make the situation doubly confusing when it comes to what you owe and how you file. But there are bright sides to the situation, too: The IRS offers special tax breaks for people over a certain age — such as a higher standard deduction for filers over 65 — and you don’t want to miss out on these helpful provisions. It can take a lot of time and research to figure it all out on your own, though, which is why having a knowledgeable professional to guide you in preparing your taxes can be so valuable.

Even if you’re not a senior, getting free help doing your taxes simplifies the process. That’s what makes AARP’s free tax-prep services particularly helpful — they’re open to everyone, regardless of age. Find out what’s involved with these services and how they can help you.

What Is AARP’s Free Tax Prep?

AARP created its tax program, AARP Foundation Tax-Aide, in 1968. In the decades since, it has provided tax assistance to almost 50 million taxpayers. In the past, taxpayers using the service received more than $200 million combined in average in earned income tax credits every year and $1.4 billion in annual income tax refunds — all without having to pay for tax prep. The program’s vice president, Lynnette Lee-Villanueva, notes, “For more than 50 years, we’ve helped lower-income taxpayers file their taxes through Tax-Aide, and in that time, we’ve seen how even modest refunds can be a lifeline for older adults who struggle to make ends meet.”

But what exactly is AARP’s Tax-Aide service? Run by trained volunteers who are certified by the IRS, the program helps people figure out how to fill out and file their tax returns. These volunteers are available to assist with a variety of tasks that fall within the scope of their training, much of which revolves around Form 1040. However, volunteers can also help you prepare your taxes when you have self-employment income, certain investments and other types of tax-related needs, depending on the issue at hand. Volunteers are even able to assist you with filing a variety of forms you may need to include with your taxes. The program is intended for people who are at low and middle income levels, and this is reflected in the available prep services — Tax Aide can’t assist with most of the more complicated tax matters.

What if it isn’t Tax-Aide’s late-January to mid-April operations season? Tax-Aide volunteers are also available year-round to provide help and answer questions online. You can submit a request via the AARP Foundation website and a volunteer will get back to you with more information and further instructions.

Finding a Location Near You

While the program initially had age and income requirements, leaving it open only to AARP members aged 50 and older with low to moderate incomes, today’s version of AARP’s free tax-prep services doesn’t have any age or income requirements. The foundation operates in more than 5,000 locations throughout the United States in easy-to-access spots like banks, senior centers, libraries and malls.

You can find a location online or by calling 888-227-7669. Keep in mind that the online location finder doesn’t provide an accessible list until the regular tax season when prep stations are actually open. If in-person tax preparation is not possible or accessible to you, such as it was during the initial novel coronavirus outbreak that took place during 2020’s tax season, Tax-Aide may provide taxpayers with access to no-cost tax-prep software to prepare and file their tax returns. TurboTax and OnLine Taxes are two of the services Tax Aide has recommended.

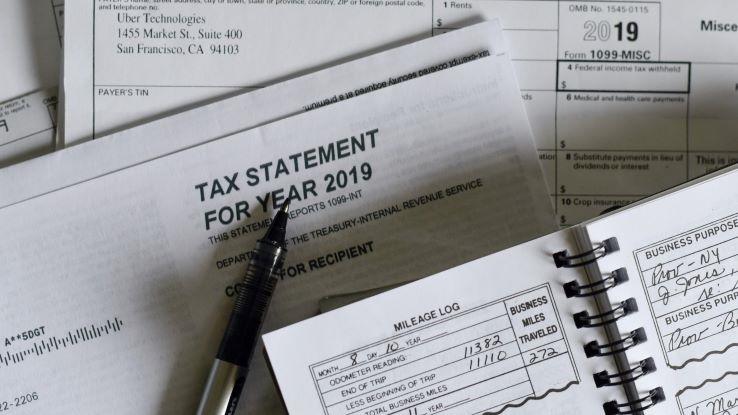

Gather Important Documents

Whether you’re taking advantage of AARP’s free tax-preparation services or you’re doing it alone, you need to have key documents on hand to get the job done. If you’re still working, you’ll need a W-2 from each of your employers. If you receive Social Security benefits, you’ll also need an SSA-1099 that shows the total amount of benefits you received for the year. If you retired from the railroad, you’ll need an RRB-1099 that shows your Railroad Retirement benefits. If you receive a pension, IRA distribution or annuity, you need to have your 1099-R to file. If you have a business, bring your 1099-MISC or other forms listing your income and expenses to your Tax Aide appointment. To see the full list of recommended documents to bring to your Tax Aide appointment, visit this website.

You also need to have last year’s tax return on hand. In addition, have handy your proof of identification, bank account information for direct depositing your refund or paying for any amount due, and official documentation like Social Security cards for everyone listed on the return.

Other Free Tax-Prep Resources

If, for some reason, AARP’s free tax-prep services don’t meet your needs, there are other options to consider. Tax Counseling for the Elderly is a federal program that gives people age 60 and older free tax-prep assistance from IRS-certified volunteers. Another federal program, Volunteer Income Tax Assistance, is open to people with disabilities and those who make no more than around $55,000 per year, an amount that may change in the future.

There are also online resources, including IRS Free File, that allow you to file your taxes online. Other programs to consider include Credit Karma Tax and TurboTax, both of which offer free filing for state and local taxes for many individuals.