Making an international transaction should be easy, yet it is one of the most challenging procedures we can think of. Certain errors regarding international transactions can cost a lot of money or delay the process of sending money. If you are looking to make an international transaction, you have probably heard of an IBAN number and how it can help you make your transactions seamless.

This article will discuss everything you need to know about IBAN Bank numbers and explain how they differ from SWIFT codes.

What Is an IBAN Number?

An International Bank Account Number (IBAN) is a code that you can use to identify bank account numbers when making international transactions. The number is essential in recognizing accounts in international transactions.

Before the introduction of IBAN numbers, banks used different identification methods in international transactions. Even though these methods were quite effective in several regions, there was always a probability for error. When a code was effective in one area, it would not also apply in another area.

IBANs were created since they would apply to all countries worldwide, which saw a reduction in the number of errors in international transactions. The IBAN system started in the EU, and then other regions such as the Middle East and the Caribbean slowly adopted it. Many countries currently use IBAN numbers, making them reliable for international transactions.

How Do IBAN Numbers Work?

When you have the IBAN numbers of a bank, the next step would be making an international money transfer. The essence of the IBAN number is to make international transactions easier. The numbers help bankers identify the country where a bank is located and the recipient’s bank number.

An IBAN number also makes it easier to examine transaction details. Identification and checking is a method that European Union and European countries often rely on. IBAN numbers assure that bankers are making the correct transactions.

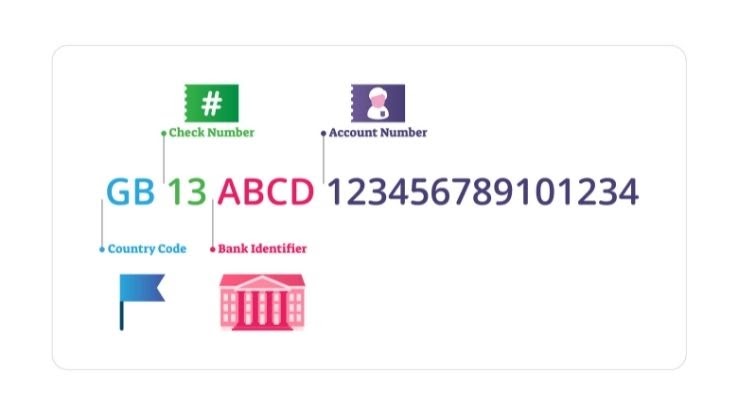

To better understand how the IBAN numbers work, here’s an example of what the IBAN digits represent:

Consider the following example; GB 38 LOYD 606243 23987623

This is an example of a code with each element grouped depending on what they mean. Here is the meaning of each element:

- The Country Code: The first two letters represent the country code. In this case GB stands for Great Britain.

- The Check Digits: These are the numbers coming after the country code. In this case, 38 is the check digit. The bank calculates these numbers for the account holders. Banking systems rely on these numbers to ensure that there are no mistakes. These numbers limit the occurrence of avoidable mistakes.

- The Bank Identifier Code (BIC): The next four letters after the check digits represent the Bank Identifier Code/SWIFT Code. The four letters are unique, and identify a specific bank. In the above example the BIC code is LOYD, identifying the Lloyds Bank. The SWIFT code identifies the bank to where the money will be sent to. However, note that the bank identifier differs in different regions. For instance, in France, the bank code may be represented by up to 5 letters.

- The Sort Code: The six numbers following the bank code represent the sort code. The sort code identifies the bank holding the account. From this example the sort code is 606243.

- The Bank Number: The last set of numbers following the sort code is the bank number. From the above example the bank account number is 23987623. The bank account number often differs from bank to bank, and can go up to 17 digits. In countries such as France there might be more digits after the Bank number.

Knowing what each number represents will help you in the identification process. On the other hand, banks will have seamless ways of processing transfers.

IBAN Number vs. SWIFT Codes

Financial institutions and banks globally recognize IBAN and SWIFT codes in identification methods. They both perform a crucial function of ensuring that bank transfers from one country to another are seamless. However, the two codes are different since they both carry different information. Since you are bound to encounter both numbers, understanding the difference is crucial.

The SWIFT code stands for the Society for Worldwide Interbank Financial Telecommunication (SWIFT). While banks and people use IBAN to identify a person’s account number, they will use the SWIFT code to identify only the bank. Both ensure that the standardized use of codes enables people to transmit information and messages securely.

The SWIFT system assigns every bank and financial organization an 8 or 11 character code. The majority of international transactions may rely on either the IBAN code or the SWIFT codes. These standards ensure that financial institutions can access a wide range of information ranging from financial data, debit and credit amounts, and account status.

The banks, the countries, and the origin of the transfer will often determine the identifier for the transactions. You should always have access to both IBAN and SWIFT codes for successful international money transfers. The chances of having a money transfer without both codes are very minimal due to the need for safety.

What Banks Have IBAN Numbers?

Most banks have IBAN numbers. However, in the US, most banks will use the SWIFT codes or routing numbers. On the other hand, IBAN numbers remain popular in European Union countries, the Middle East, and the Caribbean, where banks depend on IBAN for swift transactions.

How to Find a Bank’s IBAN Number

There are several ways you can use to find a Bank’s IBAN number. One way you can find your IBAN number is by logging into your online banking system and viewing your account details. You can also find the IBAN number by checking your bank statement on the top right-hand side.

There are companies that often handle international money transfer services. These companies may offer checkers for IBAN numbers. You can use the checkers to get the IBAN numbers before making an international transaction when using these companies. Be sure to always verify the number before making a transaction since failure to do so may cost you a lot of money.