When in debt, it can feel like you are drowning; no matter how much you try to get out of it, things just keep getting worse. This is mainly due to compounding interest and late fees that will leave you paying very little money towards the principal balance. Before trying to get out of debt, you should make a list of all of your current debts, including any creditors you owe money to. From here, you can begin setting goals to pay them off or look into other measures to eliminate them.

If you are personally going to negotiate with debt collectors, it is a good idea to have some money on hand just in case they make an offer to settle the debt for a reasonable amount. However, be leary of giving out personal information to someone you do not trust, and when in doubt, ask them to send a letter in writing.

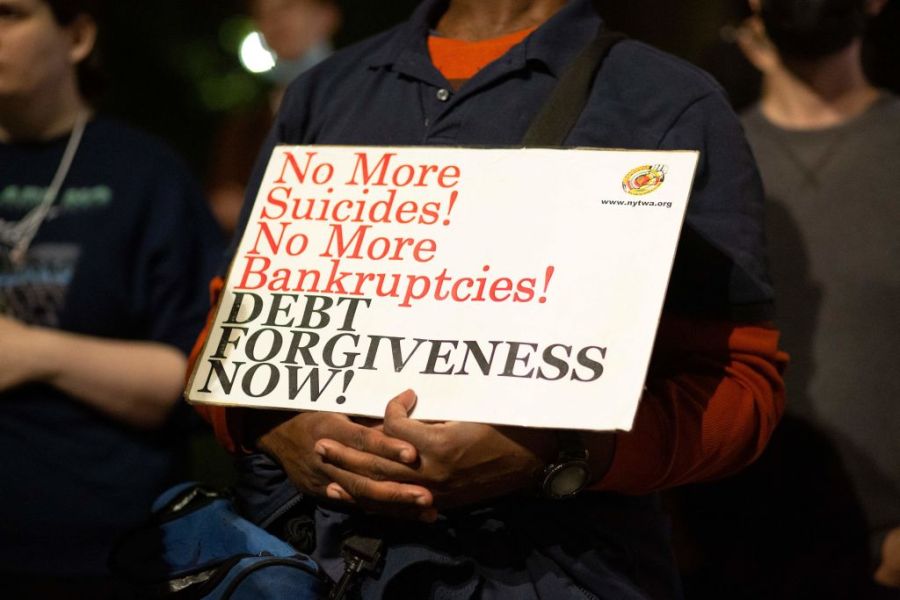

Are Debt Forgiveness Programs a Scam

Hearing “debt forgiveness program” may elicit thoughts of scams and for good reasons. No shortages of schemes claim to eliminate debt, but in the end, just take money from the unsuspecting.

However, not all debt forgiveness programs are scams, and many options exist to help get rid of or consolidate debt. The struggle can be to find actual help in an industry of companies preying on unsuspecting and, at times, desperate clients. Therefore be cautious of working with anyone who claims they can relieve you of debt through means that seem too good to be true. This especially includes anyone that requests payments to fix your credit as these are typically scams that do nothing to relieve you of debt.

Debt Forgiveness Programs Options and Considerations

A major benefit of debt forgiveness is getting rid of the overwhelming feeling of debt and improving your financial situation. Moreso, going with a bankruptcy option may personally feel like giving up, but it will put you in a position where you can pay an affordable amount.

Debt forgiveness certainly sounds like a positive thing, but there are some cons that you should consider. First, not everyone is eligible for debt forgiveness, and depending on your situation and type of debt, there may be nothing that can be done to help. Additionally, debt forgiveness may actually harm your credit. While this won’t be a major concern for everyone because a temporary dip in your credit score is likely well worth it.

Consolidation

One option to consider pursuing is a debt consolidation loan which is not really forgiveness because you will end up paying the entirety of your current debt. However, a consolidation loan is good for high-interest loans and credit card debt that is hard to overcome.

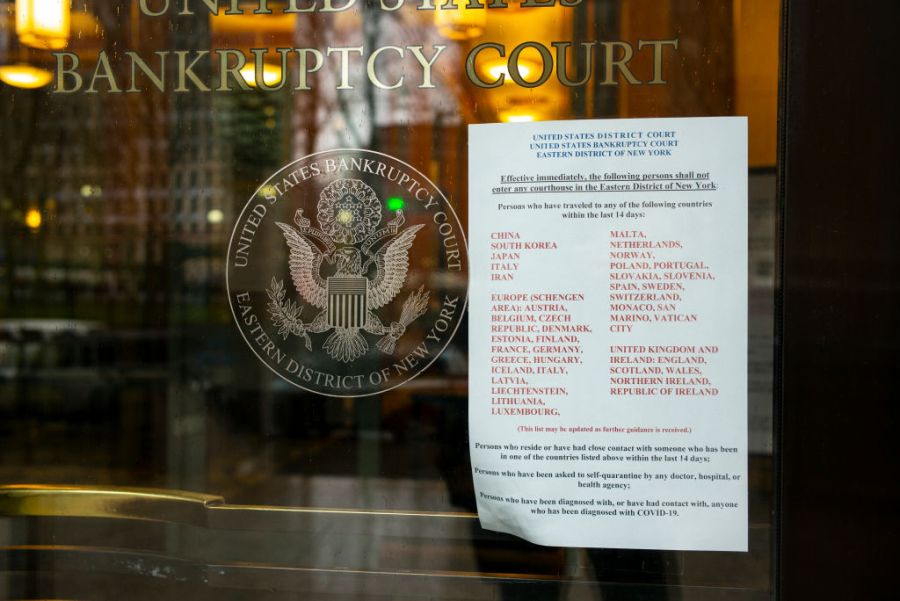

Bankruptcy

Some consider bankruptcy a last resort that should never be considered, but this is far from true. If you find yourself in a position where it is impossible to pay your creditors, you should contact a bankruptcy attorney to discuss your options and see if it may be the right option for your situation.

Keep in mind that even bankruptcy is not the end of the world for your credit score. However, it will take a couple of years to build back up.

What Debt Should You Try to Get Forgiven

Unless you pursue bankruptcy or other consolidation methods, you will need to choose what types of debt you want to get forgiven. Complete forgiveness is very hard and would only be possible in minimal circumstances.

If you have different types of debt, such as credit cards and loans, try to focus on getting specific types or even specific lines of credit forgiven. This will help split up the workload and make the task much more manageable.

Student Loans

Student loans are the least likely to be forgiven, so it is probably best to put those negotiations off until the end. Start with any tax debt as the IRS will garnish wages and has far more power than any other debt collector.

Loans and Credit Cards

You should also prioritize higher interest debt such as credit cards and personal loans from the start, but only after tax burdens are settled. After you have worked something out with those, then you can move on to larger loans such as mortgages and auto loans. However, if your home is close to foreclosure, worry about that first as any other debt is much less relevant than having somewhere to live.

Medical Bills

Of least concern should be medical bills because even though they are reported to credit bureaus, they will not gain interest the way other debt will. If you have medical bills that have not yet gone to a collection agency, you can get on a payment plan to prevent them from doing so.

Medical bills can often be partially forgiven depending on a person’s financial capabilities. This will usually require you to inquire with someone in billing and fill out financial aid paperwork. It is important to do this before it gets sent to a collection agency.

If your debt has been sent to a collection company, they’ll usually settle for a smaller amount than you owe. However, proceed carefully and make sure you keep good documentation of anything you do.

Who Is Eligible for Debt Forgiveness Programs?

Debt forgiveness eligibility varies by company, but there are some common instances where people are eligible for forgiveness. Men and women who are disabled or deceased are sometimes eligible for debt forgiveness, but not all of the time. There are also cases where those struggling financially can have their debt forgiven.