Each day, robotics and artificial intelligence are revolutionizing how we live, work, and play in the modern world. If you’re an investor, then you may be looking to ride the waves of success created by some of the world’s most innovative companies. We’ve compiled a list of great robotics companies that are definitely worth looking into and adding to your watch list.

Best Robotics Growth Stocks for Long Term Holders

- Intuitive Surgical Inc. (ISRG)

- Fanuc ADR (FANUY)

- NVIDIA (NVDA)

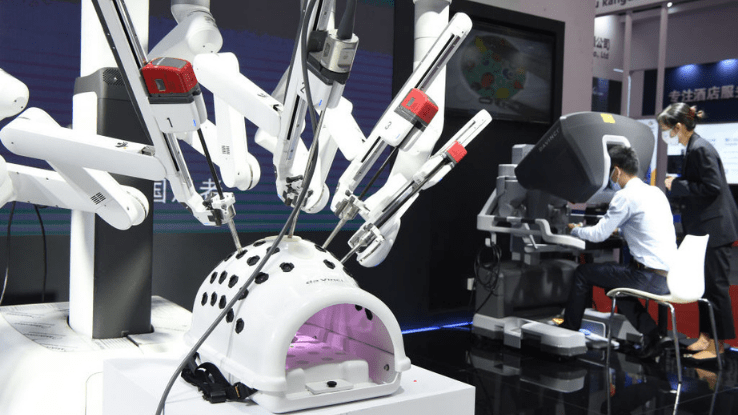

Intuitive Surgical Inc. (ISRG) was among the first pioneers of robotic surgery and was first developed as a means for treating wounded soldiers in military war zones. Eventually, Intuitive’s technology was adopted by the broader healthcare community at large, with the da Vinci surgical system becoming one of the company’s better known-products.

Admittedly, Intuitive is facing more competition these days, as competitors such as Medtronic (MDT) and Stryker (SYK) are now expanding further into the robotic surgery space. While both are worth researching and adding to your watchlist, Intuitive tends to be a tried and true long-term option for many investors. With a $126 billion market cap and 12% sales growth over the last three years, Intuitive has enjoyed a 33% price hike from January 2021 to January 2022.

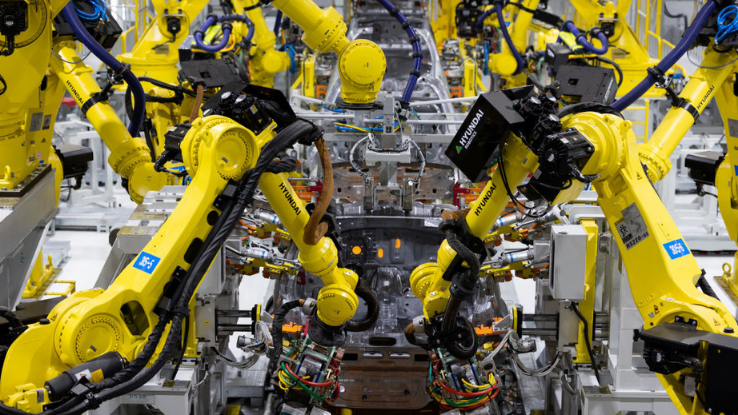

Another great stock to look into is Fanuc ADR (FANUY). Though it’s currently trading for less than $30, Fanuc is a company that you’ll see in the top holdings of many robotics and artificial technology electronic transfer funds (EFTs). Fanuc is actually a group of Japanese companies that focus on a variety of cutting-edge products, such as factory and manufacturing robotics solutions. With revenue up over 37% last quarter and net income growth of 101.64%, the OTC stock could be an interesting long-term play.

When it comes to an impressive track record, look no further than Nvidia (NVDA), a company that designs technology components for products ranging from gaming systems to automobiles. Not only does Nvidia offer an impressive array of cross-sector technology, but its technical performance is about as solid as it gets. Its average earnings per share (EPS) growth over the last three quarters is over 80%, and it pulled in 50% sales growth last quarter alone. Investors who got in on NVDA at the beginning of 2021 have enjoyed a 118.50% price hike since.

Best Tech Stocks With Plenty of Momentum

- Ambarella (AMBA)

- Teradyne (TERA)

- Omnicell Inc. (OMCL)

It didn’t take Wall Street long to figure out that a great way to play the technology sector at large was to invest in companies that produce semiconductors. Semiconductors are used in everything from smartphones and digital cameras to televisions, household appliances, and more. Ambarella (AMBA) is at the top of the semiconductor game and hence a leader in one of the top-performing sectors on the market. Its products have a huge array of applications ranging from autonomous driving to security cameras. With a staggering 533% EPS change last quarter alone, Ambarella is a great momentum play.

Teradyne (TERA) is yet another solid tech stock to keep an eye on. The Massachusetts-based company is best known as a test equipment designer for various high-profile clients, including Intel, Samsung, IBM, Texas Instruments, and more. To put it simply, Teradyne is where other robotics companies go to make sure their new products work and to find solutions to any glitches that are revealed.

Teradyne is currently on a financial roll and has enjoyed four consecutive years of annual EPS growth. With solid sales and margins, the company’s stock has enjoyed a price hike of over 36% from January 2021 to January 2022.

Last but not least, there’s Omnicell Inc. (OMCL), a healthcare tech company that manufactures systems designed to automate medication management in hospitals, pharmacies, and other medical settings. Omnicell has enjoyed an impressive 89.3% average EPS growth over the last three quarters and enjoyed a $61.33 price hike from January 2021 to January 2022. Its chart shows a slow but steady rise that may be worth hopping aboard.

Robotics Value Stocks With Lots of Upside Potential

- ABB Ltd. (ABB)

- iRobot (IRBT)

- UiPath (PATH)

Value investors looking to get in early on robotics with strong future potential will find plenty of companies worth looking into in the robotics sector. Among the best are ABB Ltd. (ABB), a Switzerland-based tech company that produces products geared towards automation, motion, robotics, electrification, and more. While the company was hit hard by COVID-19, its sales and net income mounted a recovery last year, with a current year EPS Est. change of 49%.

If you’re looking for a potential turnaround, then iRobot (IRBT) may also be worth adding to your watchlist. The company is widely known for its robotic cleaning solutions, most notably the Roomba. iRobot entered 2022 at the lower end of a 52-week range of $63.37- $197.40 and could be in for a nice upside once it manages to find a solid support level.

Yet another company to watch is UiPath (PATH), a newcomer to the market since its initial public offering (IPO) in April of 2021. The company entered 2022 trading at the bottom of a 52-week range of $39.30 – $90.00, despite reporting stronger than expected earnings in December 2021. Luckily, the company’s struggle to find its market footing wasn’t enough to detour investors such as Cathie Wood, who took the opportunity to buy the dip. Why? Likely because the idea behind the company is a good one.

UiPath Inc. is all about creating software that can increase business efficiency by automating tasks that traditionally would be manually performed by employees. From simple, repetitive tasks to complex processes, UiPath’s software can go a long way towards increasing efficiency so employees can focus on more critical tasks. The company is currently enjoying strong growth and retention but seems to be waiting for the market to catch on to its impressive fundamentals.

Hopefully, we’ve helped point you in the direction of some of the best robotics stocks worth adding to your watchlist. As always, be sure to do your own research before investing in any asset to make sure that your choice aligns with your own particular trading style and risk tolerance.