Many of us might leave high school knowing just a few financial basics — things like writing a check or saving money for a bigger purchase. Out of all the useful skillsets we learn before entering the adult world, for some reason personal finance readiness always seems to fall short, especially when it comes to what we’ve learned in classes. But knowing more about some of the foundational elements of financial knowledge, like creating a budget, understanding credit reports and applying for financing, are things that can help nearly everyone before they head off to college or enter the working world.

To address some of these knowledge gaps, which often last well into adulthood, a nonprofit organization called the National Endowment for Financial Education (NEFE) created an observance called National Financial Literacy Month. What originally started as a single literacy day eventually expanded into a month-long campaign dedicated to encouraging adults and young people to pursue more financial education and develop helpful financial habits. Join us for a look at the history of Financial Literacy Month and discover several ideas to help you make the most of it.

When Did April Become National Financial Literacy Month?

NEFE first planted the seeds of National Financial Literacy Month (NFLM) over two decades ago. Initially, it was a one-day event called Youth Financial Literacy Day, and it was geared toward helping high school students learn more about personal finance.

The initiative became so popular that, eventually, the Jump$tart Coalition — a nonprofit that’s committed to advancing youth literacy — took the reins to help promote the campaign on a more widespread basis. In 2000, Jump$tart took things a step further and dedicated the entire month of April to what eventually became known as National Financial Literacy Month.

Jump$tart still holds nationwide events and initiatives throughout the country each April and invites people of all ages to join in the challenge of expanding their financial horizons. Whether you take part in one of the official events or commit to learning more on your own, there are plenty of ways you can use the month of April to get more familiar with your finances. Below are several ideas to get you started.

Assess Your Personal Finances

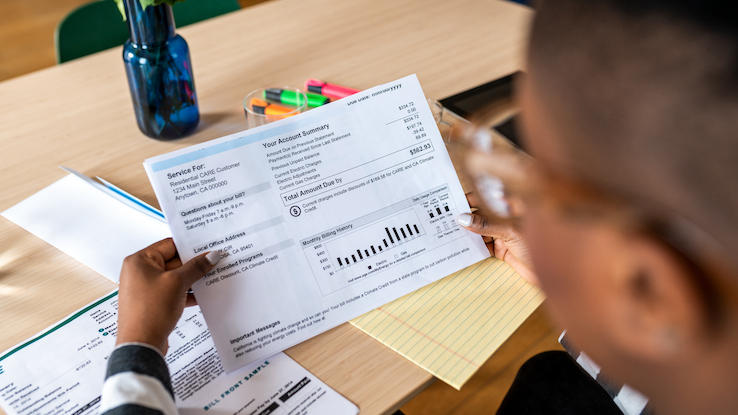

One of the hardest parts of getting a handle on your finances is sitting down and taking a good look at them. One great way to kick off the NFLM challenge is to set aside an afternoon to get a good overhead view of your current financial health.

Rather than simply giving your finances a quick once over or checking your online bank balances, now’s the time to take things a step further — to really do a deep dive into the details and address things you’ve been putting off. Gather up all your unopened bills, pull up your bank and credit card accounts online, and take a solid inventory of what you have, along with who and what you owe. While it may take a few hours, simply getting a realistic grasp of where you stand financially is a vital starting point.

Review Your Credit Report

There’s a reason NFLM lasts an entire month. You’ll be going through quite a few details, and it’s important to pace yourself so you can build habits that last. You’ll also have the opportunity to take care of some pretty big tasks — and you could also see a lot of progress! If you’ve taken the first step of reviewing your bills and financial accounts, feel free to set the next task aside until the next day. The next thing you’ll tackle is your credit report to get a clear understanding of your score, your open accounts and more.

The good news is that everyone is entitled to receive free copies of their credit reports from the three main bureaus once a year, and now it’s easier than ever. Simply head over to annualcreditreport.com, fill in your information and print out a copy of your free reports. You’ll be able to access your scores from Equifax, Experian and TransUnion. Give your report a careful read to check for potential mistakes and ensure overall accuracy.

Get Organized

At this point, take a moment to congratulate yourself. Facing your finances can feel overwhelming, but it’s an important step toward achieving your financial goals. Now it’s time to set yourself up for success by getting and staying organized. One great way to do this is to pick a spot in your home dedicated to keeping up with your finances.

It can be as simple as a file folder that houses all of your upcoming bills to a filing cabinet and desk where you sit down to focus on financial tasks. If you receive your bills electronically, make a new folder in your email account where you can store them. Take the time to write or type out each creditor you pay monthly and indicate which day of the month each bill is due. Next, transfer that information onto a calendar dedicated specifically to your finances. Place it somewhere that you’ll actually see it to avoid last-minute reminders or late fees. Get in the habit of using your new organization system, too, even if it means setting a reminder on your phone to do so.

Set Up a Debt-Management Plan

As you were learning more about your financial standing, you might’ve gotten a much clearer picture of your debts. Now it’s time to decide how best to begin paying them off.

Your process for going about this may depend on the amounts you owe. If you feel they’re manageable, you may want to consider adding up all of your monthly bills to see how much you owe each month. Then, open a separate debit card account, fund it with that total amount on the first of each month and set up auto-pay from this account for each of those bills.

If you’re not finding a realistic, comfortable way to pay down debts, it may be time to consult a credit counseling service. These non-profit services can help you consolidate your debt into one monthly payment that’s more manageable for you based on your income, budget and other lifestyle factors.

These, of course, are just a few of the many methods you might choose. The important thing is to develop a strategy that’ll work for you for the long term.

Set and Pursue Your Goals

Wish you could take an awesome vacation this summer? Or maybe you’d love to be able to save or invest more money for your future? Now is the time to allow yourself to dream about what your ideal financial life would look like.

Get specific about your goals and write them out or even make a vision board. Break down and list out some of the key steps you’ll need to achieve to reach them. Keep your goals somewhere you’ll see them often enough that you’ll begin to take them seriously and feel more inspired to work towards them. Whether you want to get out of credit card debt, buy a home or set yourself up for a comfortable retirement, simply having long-term goals can be a great way to keep yourself focused and on track.